The Claims Processing Crisis

Traditional insurance claims workflows are breaking under modern demands, creating operational inefficiencies and customer frustration

Agentic AI Revolution

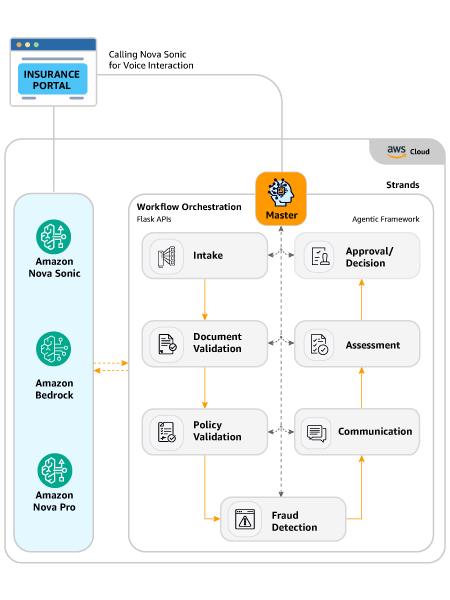

Our AWS NOVA-powered solution transforms claims processing from manual workflows to intelligent, autonomous operations using multi-agent AI architecture with human-in-the-loop decision making.

Complete Claims Processing Workflow

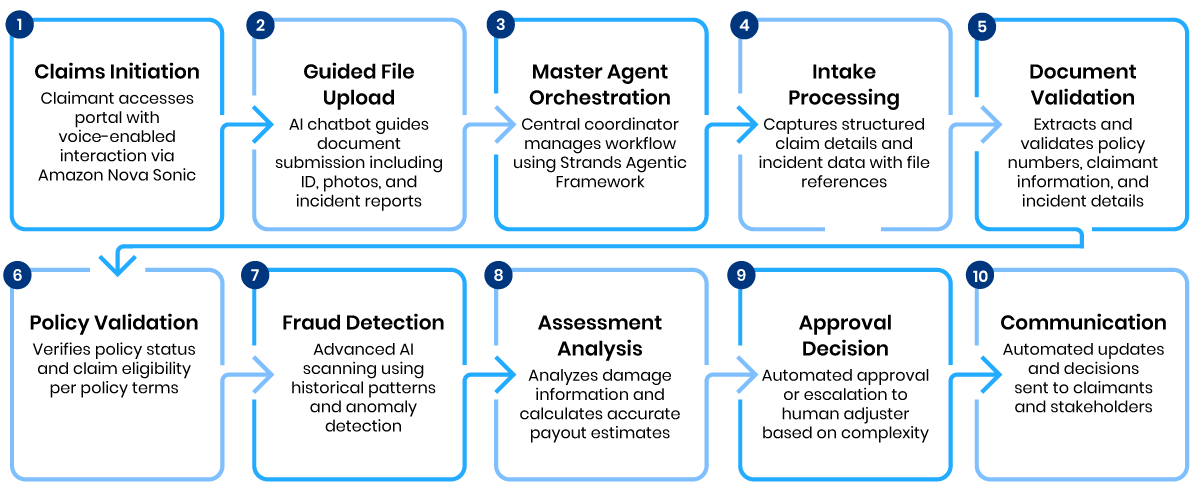

Our agentic AI solution orchestrates the entire claims lifecycle from first notification to settlement decision

Beyond Insurance Claims

Our AWS NOVA solution architecture extends across industries for comprehensive transformation

Healthcare

Prior authorization processing, patient intake automation, and medical record validation using the same multi-agent AI framework deployed in our award-winning claims solution.

Banking & Financial Services

Loan application processing, credit assessment automation, and regulatory compliance management with enterprise-grade security and scalability.

Retail & E-commerce

Customer service automation, return processing, and warranty claim management with voice-enabled interactions and intelligent decision-making.

Telecommunications

Service request automation, network issue resolution, and customer support optimization using agentic AI for improved operational efficiency.

Frequently Asked Questions

Common questions about implementing AWS NOVA-powered claims transformation

Application modernization involves updating and optimizing legacy systems to address technology constraints, meet customer experience expectations, and support adoption and integration with newer technology platforms.

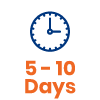

Implementation typically takes 8-12 weeks from discovery to production deployment. This includes discovery & assessment (weeks 1-2), architecture design (weeks 3-4), MVP development (weeks 5-8), testing & validation (weeks 9-10), and production deployment (weeks 11-12).

Our solution is built with enterprise integration in mind, using APIs and cloud-native architecture that seamlessly connects with existing policy management systems, core insurance platforms, and legacy applications through standardized interfaces.

The solution is designed for compliance-heavy sectors with enterprise-grade security, AWS cloud-native architecture, and frameworks that meet insurance industry regulatory requirements including data protection and audit capabilities.

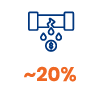

ROI is measured through operational cost savings (25-35%), processing time reduction (40-60% faster cycles), improved customer satisfaction scores, and reduced fraud losses. Most clients see positive ROI within 6-9 months of deployment.

Yes, the solution is designed for elastic scalability to handle volume surges in consumer-facing, high-demand markets. The AWS cloud-native architecture automatically scales resources based on claims volume and processing demands.

Trusted by Industry Leaders

Over two decades of supporting the largest insurance companies globally with proven transformation expertise

20+

Years Transforming Enterprises

95%+

Customer Retention

#1

Customer Satisfaction 6 Years Running

Global Presence

Powering transformations across 4 continents

RevolutionAIzing Digital Transformation

Trianz is a transformation solutions company that accelerates customer business transformation through end-to-end platforms leveraging the cloud, hyper-automation, and Agentic AI. With over 20 years of transforming enterprises and a global presence powering transformations across four continents, Trianz has evolved from traditional IT services to become a platform-led, AI-driven digital transformation leader positioned for exceptional growth. Driven by its customer-centric approach and expertise across Cloud, Gen AI, Analytics, Digital Engineering, and Security, Trianz serves as the premier partner for enterprises seeking to transform operations, experiences, and competitive positioning through scalable digital ecosystems.

The Unified Enterprise Transformation Platform

Concierto represents a paradigm shift from traditional consulting to a unified, AI-powered, multi-cloud native platform that delivers enterprise transformation at unprecedented speed. This comprehensive platform integrates five core modules - Migrate, Modernize, Manage, Maximize, and Insights & Agentic AI - to provide end-to-end transformation capabilities from cloud migration and application modernization to autonomous intelligence and decision-making. Concierto eliminates the complexity of managing multiple vendors and point solutions by offering a single, integrated platform that delivers complete business outcomes in weeks rather than months, and significant cost savings compared to traditional approaches, making it the definitive platform for enterprises seeking rapid, scalable digital transformation.

Ready to Transform Your Claims Operations?

Join forward-thinking insurance leaders who are already leveraging AWS NOVA and Trianz expertise to revolutionize their claims processing with proven results and measurable ROI.