Microsoft Azure Partner

Every organization today, irrespective of its size, is transforming itself into a digital entity. Upstarts with new products/services, cloud-based models, and unique experiences providing capabilities are reshaping customer relationships and the definition of success. Additionally, we have cloud computing bringing the agility aspect into the digital transformation process by providing a platform that facilitates innovation through a framework that rapidly releases new capabilities and a pipeline for moving ideas from inception to production.

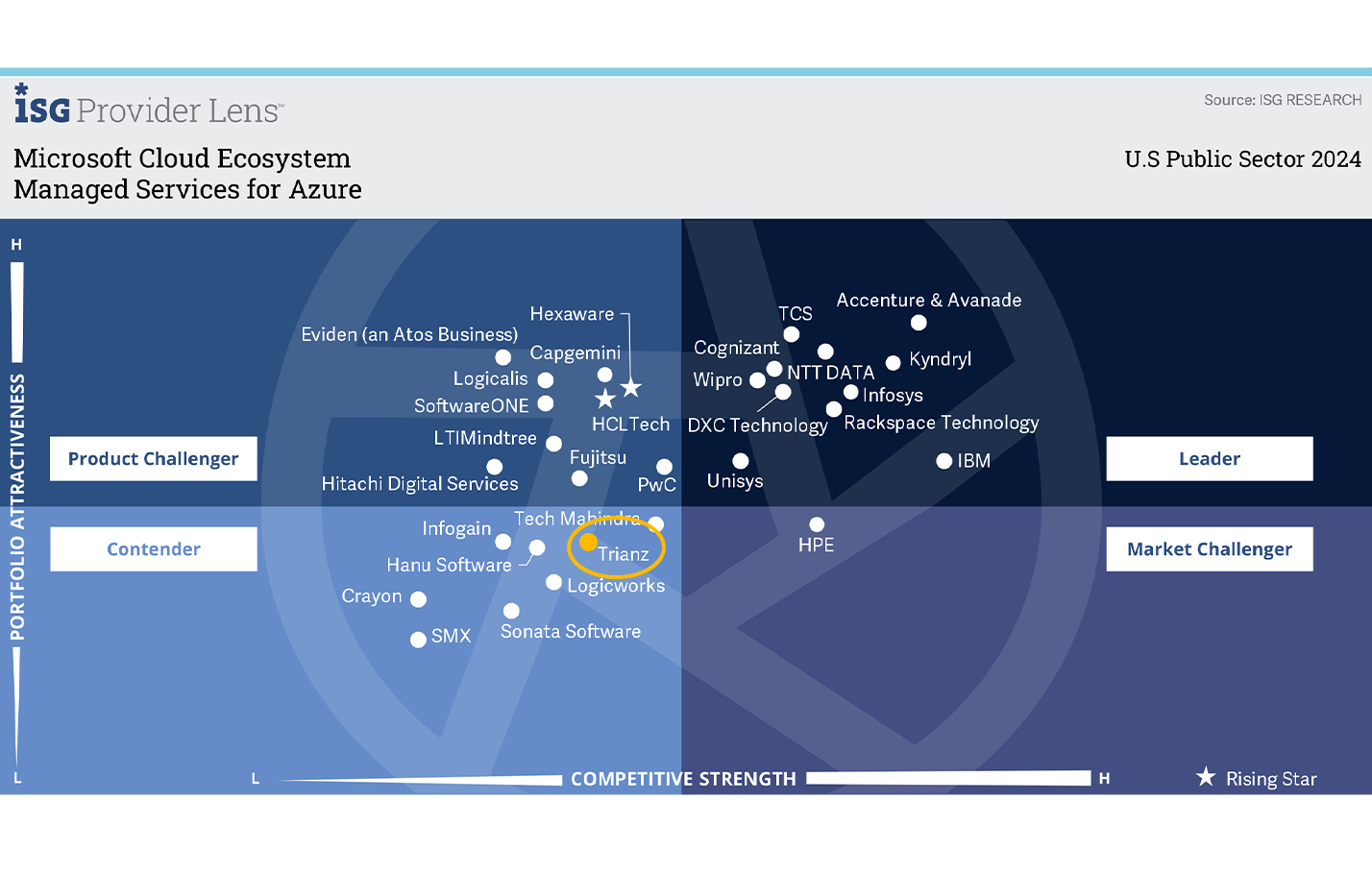

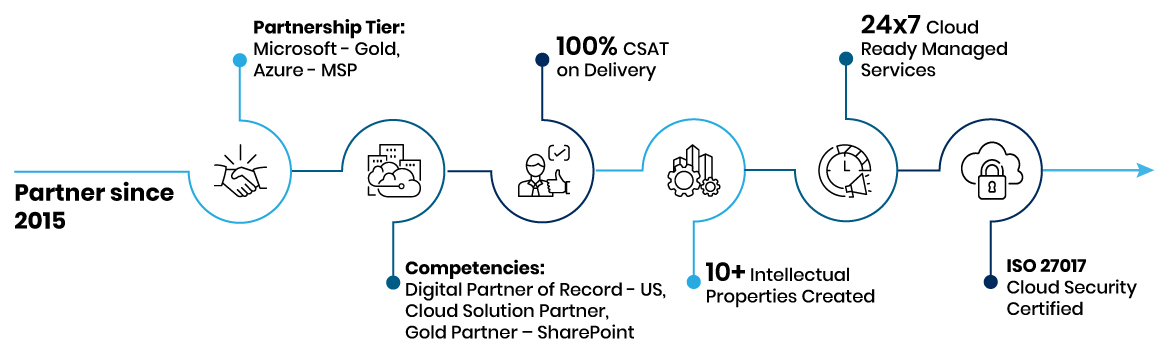

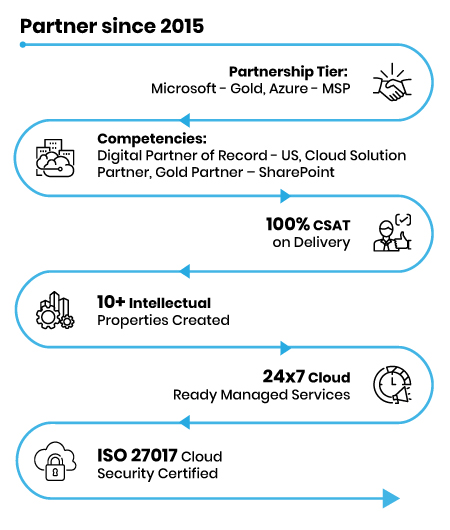

Trianz, is a Managed Services Partner for the Microsoft Cloud Solution Provider (CSP) Program. We help enterprises to plan and adopt Azure’s hyper-scale public cloud, enterprise-grade capability, and true private and hybrid cloud offerings. We also leverage Microsoft products for our clients to create new imperatives like Analytics, DB migration, DevOps using .Net Framework, SharePoint/exchange and DC migration on Azure.