Reimagining insurance claims with AWS Nova—60% faster resolutions, 35% lower costs, all through intelligent multi-agent automation

Insurance claims processing has long been burdened by legacy workflows and outdated systems. While the industry has invested heavily in digital transformation, many insurers continue to face persistent challenges—lengthy resolution times, high operational costs, and customer dissatisfaction. Claims often take 5–10 days to process, operating expenses consume 25–30% of premium revenue, and customer experience remains a major pain point.

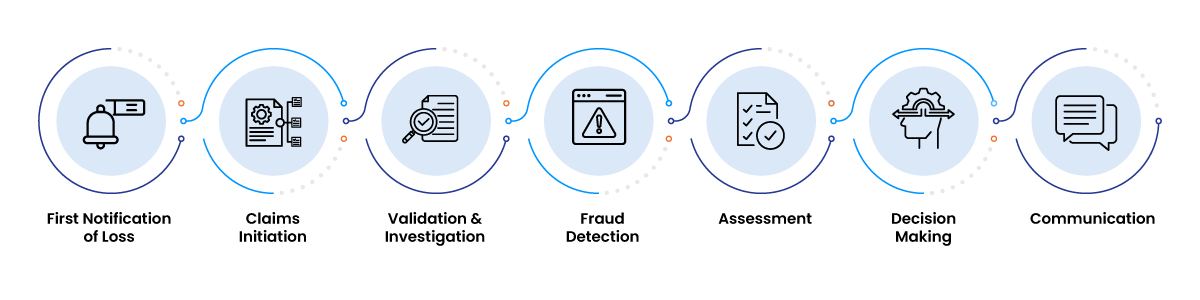

Insurance Claims Workflow

When we started this project, we knew we needed to think differently. Rather than just digitizing existing processes, we wanted to fundamentally reimagine how claims could work using AWS Nova's advanced AI capabilities within a multi-agent architecture.

The results exceeded our expectations: 60% faster processing, 35% lower costs, and 90% of standard claims now flow straight through without human intervention. But the real story isn't just in the numbers—it's in how we solved the technical challenges that have plagued this industry for years. This article walks through our approach, the obstacles we encountered, and the architectural decisions that made the difference.

The Problem: Inefficiencies in Traditional Claims Processing

Before diving into our technical solution, it's important to understand the specific challenges plaguing traditional insurance claims processing:

Prolonged Resolution Times

Most insurers still rely on manual handoffs between agents, departments, and external adjusters. This sequential approach often results in claim cycle times of 5 to 10 business days, creating frustrating delays for both customers and internal teams.

Delayed Fraud Detection and Profit Leakage

Fraud screening typically occurs late in the process, after claim intake and initial validation. This lag allows suspicious claims to proceed unchecked, resulting in an estimated 5–10% in profit leakage due to delayed or missed detection.

Poor Customer Experience and Satisfaction

Customers experiencing loss or damage expect swift, empathetic service. Instead, they face long response times, repetitive document requests, and inconsistent updates—leading to low Net Promoter Scores (NPS) and increased customer churn.

Compliance Risks from Manual Oversight

Human-driven compliance checks are error-prone and time-consuming. Inconsistent documentation, missed audit trails, or improperly handled exceptions can expose insurers to regulatory fines and reputational damage.

Operational Inflexibility During Volume Spikes

Insurers often resort to hiring temporary staff to manage seasonal or catastrophic event-driven claim spikes. This reactive approach not only increases cost but also leads to inconsistent service quality due to minimal training and onboarding.

Lack of Real-Time Decision-Making Capabilities

Without intelligent automation, decisions are delayed while agents gather information, verify documents, and manually apply business rules. This reactive posture prevents insurers from delivering the responsiveness today’s customers expect.

Solution Overview: Nova-Powered Agentic Intelligence Framework

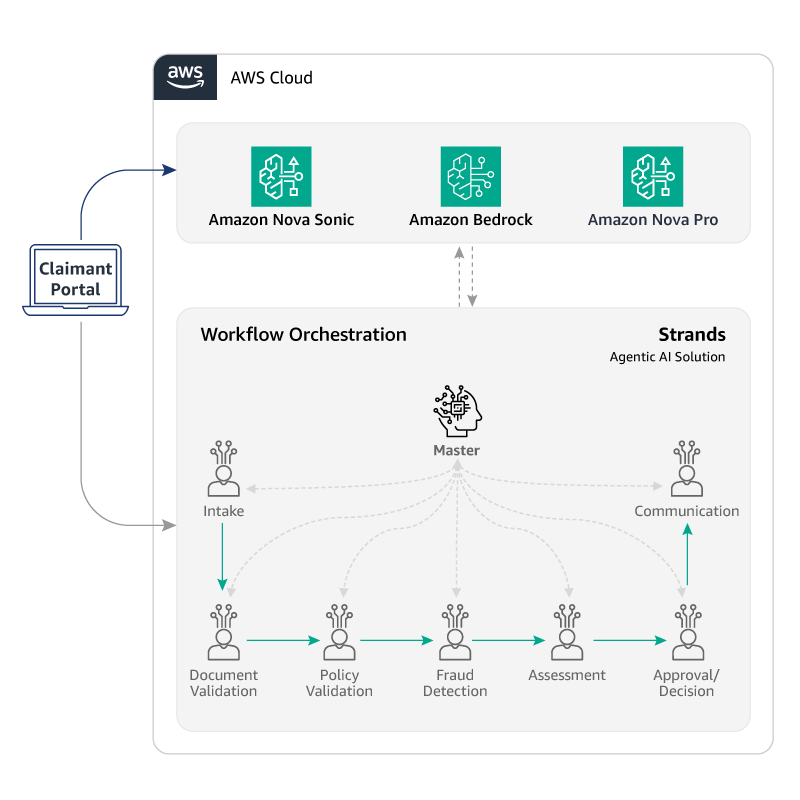

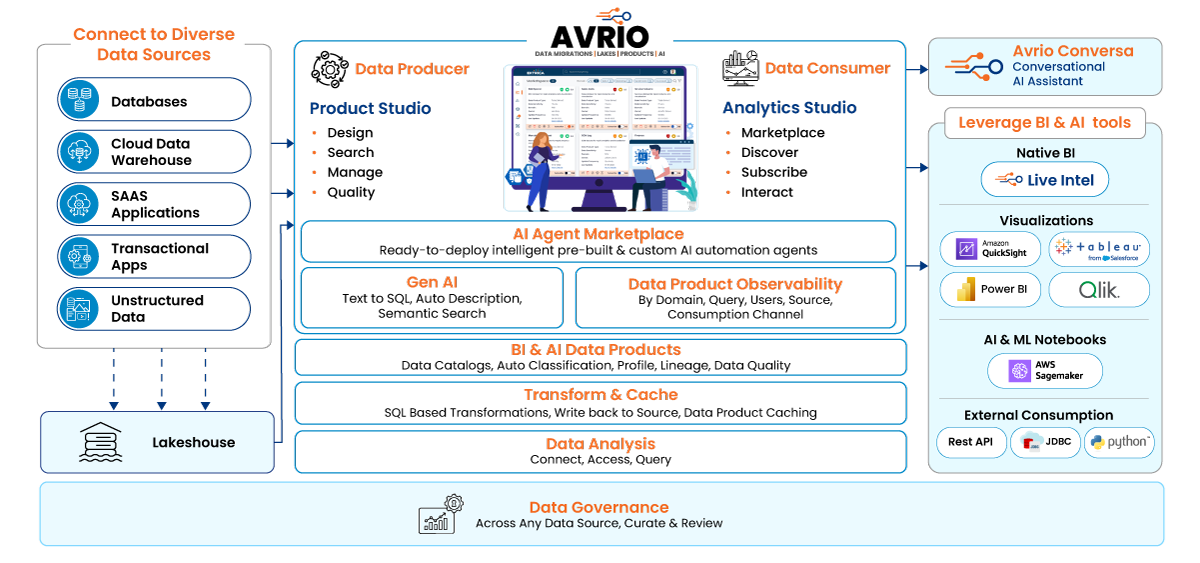

Our solution—built on the Nova-Powered Agentic Intelligence Framework—utilizes AWS Nova Sonic and Nova Pro integrated with the AVRIO platform to orchestrate a coordinated network of intelligent agents. This architecture enables autonomous, modular handling of every step in the claims lifecycle.

Core Technology Components

Nova Sonic

Captures First Notice of Loss (FNOL) through conversational, empathetic voice interfaces.

Nova Pro

Powers back-end analysis for document processing, policy interpretation, fraud detection, and valuation.

AWS Strands

Enables scalable orchestration, data exchange, and agent communication.

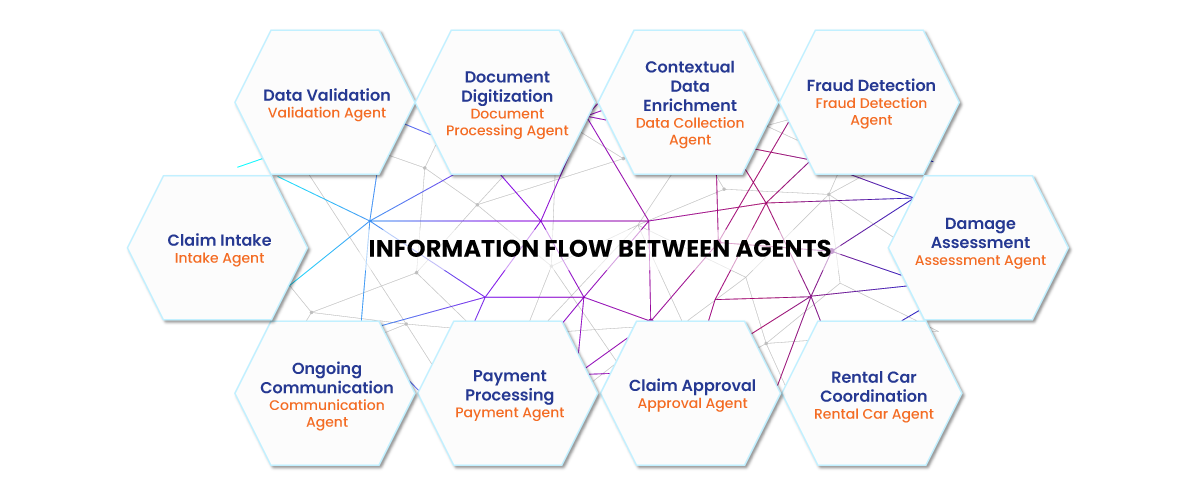

Agent Network Overview

-

Master Orchestration Agent: Coordinates specialized agents, manages workflow routing, and ensures seamless end-to-end claims processing.

-

Intake Agent: Extracts structured information from submitted documents and captures key incident details from customer inputs.

-

Document Processing Agent: Performs intelligent document ingestion with automated data extraction and deep validation to ensure all required documents and information are present.

-

Validation Agent: Verifies policy status and assesses claim eligibility, with human-in-the-loop triggers for low-confidence scenarios.

-

Fraud Detection Agent: Conducts real-time anomaly detection and flags suspicious claims for further investigation.

-

Assessment Agent: Generates automated claim valuations using AI-based damage assessment and integration with third-party service providers.

-

Communication Agent: Delivers proactive updates and personalized engagement across customer-preferred channels.

Implementation Walkthrough

Our autonomous claims solution follows a multi-agent architecture powered by AWS Nova Sonic and Nova Pro, orchestrated through the AVRIO platform. Below is a phase-wise breakdown of how each agent contributes to the end-to-end process.

The customer journey begins with our Intake Agent, powered by Nova Sonic, which provides a conversational interface through our Insurance Portal. This agent demonstrates remarkable emotional intelligence, adapting its communication style based on customer stress levels and claim complexity.

The claimant accesses the Insurance Portal to initiate the claim and can optionally use Amazon Nova Sonic for voice-based interaction via a chatbot. The system guides customers through the FNOL process with empathetic responses, understanding context and emotional state to provide appropriate support during stressful situations.

The chatbot, powered by Nova Sonic, guides the claimant to upload necessary documents such as ID, incident photos, and reports. The system intelligently requests specific documentation based on the claim type and automatically validates file formats and completeness.

Claimants upload files based on this guided interaction, with the system providing real-time feedback on document quality and completeness. The interface adapts to different device types and provides clear instructions for optimal document capture.

The Master Agent, running on Flask APIs hosted on EC2, orchestrates the workflow using the Strands Agentic Framework. It coordinates all downstream agents in the claim process, ensuring proper sequencing and data flow between different processing stages.

The Master Agent maintains context across all agent interactions, handles error scenarios, and ensures that human intervention is triggered when necessary. This orchestration layer is critical for maintaining workflow integrity and ensuring that no claim falls through the cracks.

The Intake Agent captures structured claim details including incident data and references to uploaded files. Using Nova Pro's advanced natural language processing capabilities, it extracts key information from unstructured text and converts it into structured data formats.

The agent efficiently processes both printed and handwritten documents, extracting structured data from diverse file types. It can optionally prioritize urgent cases, flag incomplete or unclear submissions, and ensures that any documents requiring human review are promptly escalated for accurate and timely resolution.

The Document Validation Agent reviews uploaded documents and performs analysis to confirm that all required documents are present for the claim process to continue.

The agent meticulously cross-verifies all provided documents against the required documentation checklist for the specific claim type. Any missing documents are flagged for both human oversight and prompt follow-up with the customer. The agent conducts thorough quality assessments to confirm that each submitted document is not only present but also complete, ensuring a seamless continuation of the claims process.

The Policy Validation Agent validates policy status and ensures the claim is eligible per policy terms. It performs comprehensive checks including coverage verification, premium payment status, policy effective dates, and exclusion analysis.

The agent integrates with core insurance systems to access real-time policy information and can handle complex policy structures including multiple coverages, riders, and endorsements. It automatically calculates applicable deductibles and coverage limits.

The Fraud Detection Agent scans the claim for potential fraud using historical patterns and anomaly detection. Leveraging Nova Pro's pattern recognition capabilities, it analyzes multiple data points including claim history, incident patterns, and behavioral indicators.

The agent maintains a continuously updated fraud pattern database and can identify sophisticated fraud schemes that might escape traditional rule-based systems. It assigns risk scores and automatically escalates suspicious claims for investigation.

The Assessment Agent thoroughly reviews validated data and detailed damage information to generate an accurate payout estimate. By drawing on claim data, it seamlessly connects with external services for repair cost estimation, parts pricing, and current labor rates, ensuring precise and fair valuations at every step.

The agent considers multiple factors including depreciation, market conditions, and regional variations in repair costs. It can handle complex assessments involving total loss calculations and salvage value determinations.

The Approval/Decision Agent makes an approval decision based on configured rules or escalates to a human adjuster if needed. It applies business rules, regulatory requirements, and risk thresholds to determine appropriate actions.

The agent maintains detailed audit trails of all decisions and explains its reasoning for compliance, while handling different approval levels based on claim value and complexity.

The Communication Agent sends updates and final decisions to the claimant and internal stakeholders via email or message. It uses Nova Sonic to generate personalized communications that maintain appropriate tone and provide clear next steps.

The agent manages multi-channel communications through email. It can handle complex communication scenarios such as partial approvals, additional information requests, and settlement negotiations.

Key Enablers of Success

Seamless Integration

The system integrates with existing infrastructure without requiring wholesale replacement, minimizing implementation risk and cost.

Built-in Compliance

Human oversight mechanisms at critical decision points ensure regulatory compliance while preserving the benefits of automation.

Autonomous Intelligence

AI agents operate independently and continuously learn, leading to ongoing performance improvements.

Human-like Interactions

Nova Sonic enables immersive customer experiences that feel both natural and empathetic.

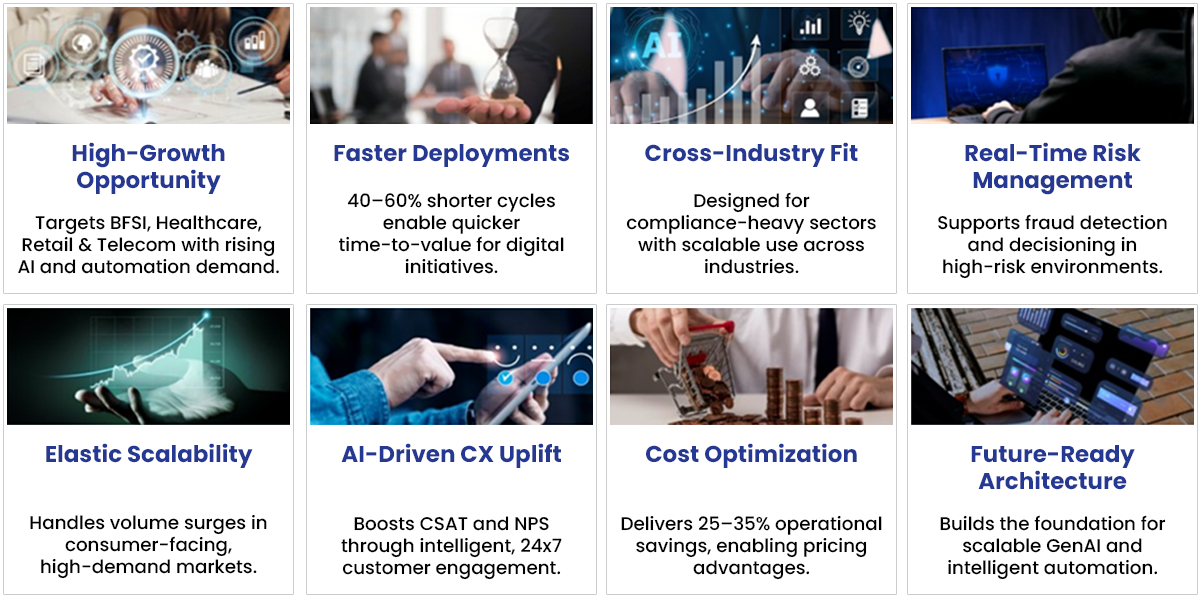

Quantifying the Impact: Speed, Savings, and Satisfaction

Our Nova-powered agentic AI solution can deliver transformative operational results that exceed initial projections. The scalable, modular architecture can reduce claims cycle time by up to 60% and operational costs by 35%, while achieving 90% straight-through processing for standard claims. This operational excellence can translate directly into improved financial performance, with up to 20% reduction in profit leakage – driven by advanced fraud detection and elimination of seasonal staffing costs through scalable AI capacity. The system's seamless integration with existing workflows can enable automated compliance reporting and consistent service quality across all customer touchpoints.

The customer experience revolution can be equally impressive, with a potential 30% improvement in satisfaction scores driven by consistent, empathetic interactions powered by Nova Sonic's emotional intelligence capabilities. Customers can benefit from 24/7 availability for claim initiation and status updates, real-time proactive communication throughout the claim’s lifecycle, and significantly reduced stress through intelligent, context-aware conversations. This combination of operational efficiency and enhanced customer experience can improve cash flow from accelerated claim resolution while providing enhanced risk management capabilities through predictive analytics—creating a truly faster, error-free, and always-on claims experience.

Conclusion

Our Nova-powered agentic AI solution represents a fundamental shift in how insurance claims are processed. By combining the empathetic capabilities of Nova Sonic with the analytical power of Nova Pro, we've created a system that not only processes claims faster and more accurately but also provides a superior customer experience.

The success of this implementation demonstrates that agentic AI is not just a technological advancement—it's a business transformation enabler. Organizations that embrace this technology now will gain significant competitive advantages in operational efficiency, customer satisfaction, and risk management.

The modular architecture ensures that our solution can adapt to different insurance products and business models, making it suitable for organizations of all sizes. As we continue to refine and expand these capabilities, we're excited about the potential to transform the entire insurance value chain.

What’s Next in Our Agentic AI Roadmap

The success of our Agentic AI–powered Claims Adjustment solution, built on AWS Nova, represents a major leap forward—but it's only the starting point. For insurers, the real value lies in moving beyond pilots into enterprise-wide adoption that is scalable, compliant, and transformative.

Our roadmap focuses on three key phases—each designed to help clients adopt, scale, and operationalize Agentic AI responsibly and effectively.

To guide this expansion, we’ve defined a phased roadmap:

Phase 1: Operationalize Core Use Cases (Q2–Q3 2025)

Embed AI into high-impact workflows with measurable ROI.

-

Move from pilot to production in claims

-

Integrate agents with core systems (CRM, policy admin)

-

Establish monitoring, auditability, and governance

-

Train users and embed change management

-

Track KPIs across cycle time, fraud detection, CSAT

Phase 2: Enable Reuse & Internal Scale (Q3–Q4 2025)

Expand agentic capabilities across adjacent functions.

-

Deploy agents in underwriting, policy servicing, and customer support

-

Develop modular agent interfaces for reusability

-

Introduce an internal registry for agent discovery

-

Standardize compliance and security policies

-

Expand to multimodal agent interfaces

Phase 3: Build the Agentic Marketplace (2026)

Foster a governed, self-serve ecosystem of intelligent agents.

-

Launch a structured, role-based Agentic Marketplace

-

Curate reusable agents by business function

-

Enable on-demand agent provisioning and orchestration

-

Integrate with AWS Bedrock Agents and Lambda

-

Support A/B testing and rapid innovation cycles

Phase 4: Power It All with AVRIO (2026+)

Establish Trianz AVRIO as the enterprise foundation for Agentic AI.

-

Use AVRIO to host, govern, and scale the agent ecosystem

-

Enable lifecycle management and version control

-

Apply federated learning for continuous agent optimization

-

Extend access to partners and ecosystem players

-

Position AVRIO as the strategic platform for intelligent operations

Together, these initiatives will further position agentic AI as the operating model of the future—one that’s intelligent, responsive, and deeply aligned with both customer needs and regulatory demands.

Authors