In today’s digital-first world, Financial Services and Insurance (FSI) institutions face rising complexity from regulatory pressures and evolving customer demands to the constant threat of fraud and market volatility. Success now hinges on how quickly and intelligently an organization can convert its data into action.

Yet, legacy systems and siloed data continue to slow progress. Business users often struggle with fragmented information spread across claims platforms, policy systems, transaction engines, and CRM tools. Manual processes and rigid analytics pipelines delay insights and limit agility – A serious handicap in an industry where real-time decisions matter.

-

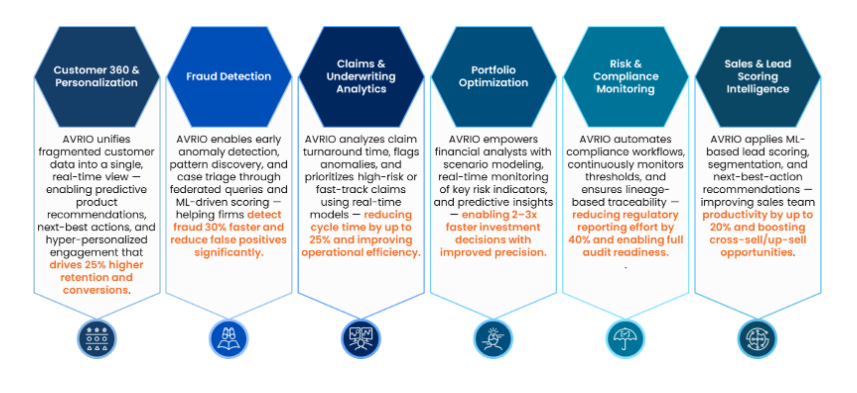

Fraud Analysts wrestle with disconnected systems that delay investigations, miss subtle patterns, and lack real-time triggers to prevent losses.

-

Underwriters and Claims Managers lack unified, explainable insights that can accelerate risk scoring, claims triage, and approval decisions.

-

Compliance Officers face audit fatigue and reporting delays due to manual data pulls and a lack of clear lineage or threshold monitoring.

-

Product and Marketing Teams can’t personalize experiences effectively when customer data is fragmented across channels and systems.

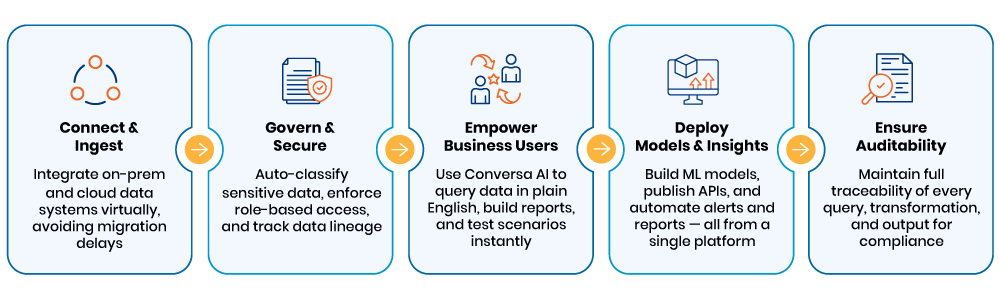

To compete and comply in this landscape, FSI organizations need more than dashboards. They need a modern, governed, AI-powered platform that turns enterprise data into intelligent, real-time outcomes.