What does the transformation of Finance Ops mean?

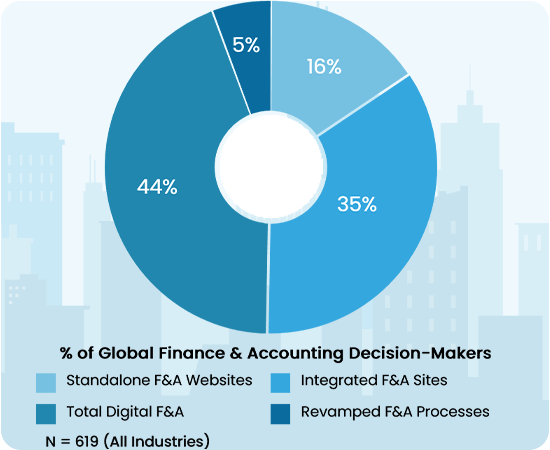

In a global study covering digital transformation vision, strategy, technology and implementation across enterprises, we asked 550+ leaders in Finance ‘what does digital transformation mean to your organization?’. Our focus was on the digitalization of finance operations:

Over 50% of respondents said digital transformations means sharing more information about how finance works through better websites and portals. Less than half the respondents have revamped their finance processes for cost saving, enhanced efficiency and, improved stakeholder experiences.

However, when we studied the responses of the most successful finance organizations who are less than 6% of the total population, we found them to better understand the definition of digital transformation of finance from their perspective.

Perceptions of Finance Operations Transformation - All Companies

Source: Trasers(Trianz Research)

The digital transformation of Finance operations has three dimensions. First, Finance has to digitalize its own business processes to gain speed and efficiency.

Second, it has move from a back-office to a front office posture with real-time integration into all major transactional processes in Marketing, Sales, Service, Manufacturing, Supply Chain and Procurement.

Finally, Finance has to become the chief proponent of a ‘data-driven’ culture by tracking, measuring and communicating performance using the language of KPIs.

We will help your Finance value chain evolve into a dynamic, integrated and KPI driven operation

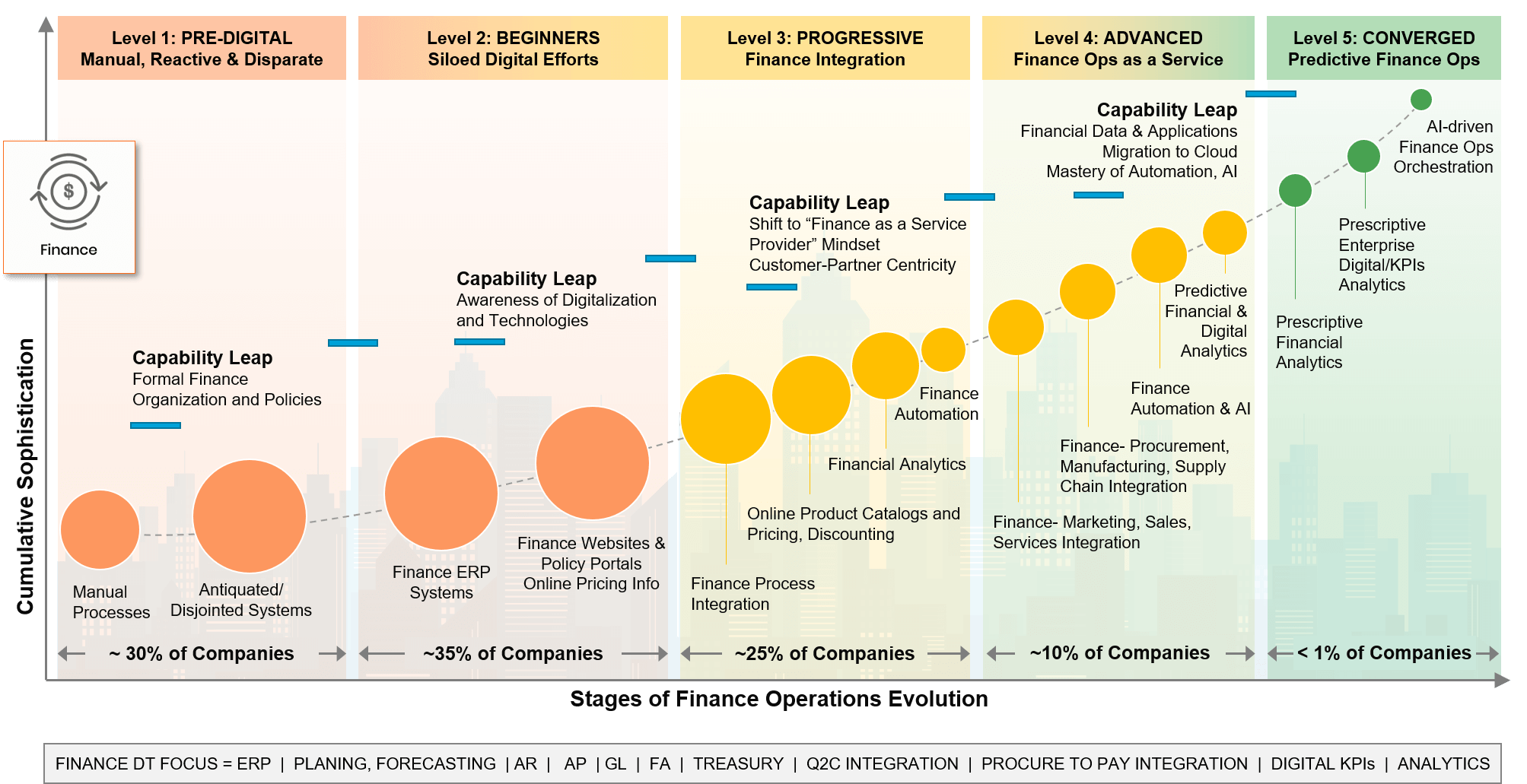

Digital Enterprise Evolution Model™ - Finance Operations

Copyright © 2022 Trianz

The name of the game in highly successful, digitalized enterprises is high-velocity, adaptability and becoming predictive. Finance is the arterial system of any organization since each function has to transact with external parties for executing their mission. In digitalized enterprises, high velocity business processes and undisrupted experience to stakeholders such as customers, partners, regulators, leadership and management is critical.

While there are many aspects to think about such as corporate finance, credit, risk management etc. the biggest near term influence in the digital transformation of the enterprise is in accounting and operations. Financial processes have to first integrate in real time and help front line functions become predictive.

These are the core transformation themes in which Trianz partners with clients in the Finance function.

Focus on Finance Ops Digitalization and Integration

Almost every well-run finance organization already leverages financial systems such as Oracle, SAP, Infor etc. However, there are processes that are highly customized and reside outside these systems and it is critical to digitalize and integrate these with front-line functions.

Invest in Financial Analytics

Making financial reporting a routine operation, Finance organizations have to evolve immediately to a predictive organization. This can only happen when you have a grip on all your financial data, integrate it and develop ‘what-if’ visualization and analytics capabilities across financial metrics.

Promote a Predictive, Data-Driven Culture

Our data shows that nearly 40% of businesses will not survive this decade as their products will become irrelevant for customers. Finance must become the nerve centre of enterprise analytics- especially focusing on customers and product/service, geographic, performance in order to help CEOs act in a timely manner.

As businesses invest in digitalization and integrate more and more across functions, financial data becomes more real-time. By deploying an “enterprise digital KPI system”, Finance can also provide objective status updates and ‘what-if’ information on progress, spending and ROI from investments.